pay utah state property taxes online

Please contact us at 801-297-2200 or taxmasterutahgov for more information. If you do not have these please request a duplicate tax notice here.

How Taxes On Property Owned In Another State Work For 2022

This web site allows you to pay your Utah County Personal Property Taxes online using credit cards debit cards or electronic checks.

. Pay over the phone by calling 801-980-3620 Option 1 for real property. Pay My Property Taxes. If paying after the listed due date additional amounts will be owed and billed.

Filing Paying Your Taxes. Remove any check stub before sending. Payment Types Accepted Online.

We have arranged with Instant Payments to offer this service to you. File pay manage your Utah taxes online. The Recorders Office and the Surveyors Office records the boundaries and ownership.

For your protection do not send cash through the mail. 1 of the payment amount with a minimum fee of 100. What you need to pay online.

Form of Payment Payment Types Accepted Online. BUSINESS CORPORATE TAXES. Do not staple your check to your return.

Steps to Pay Your Property Tax. To pay Real Property Taxes. Pay for your Utah County Real Property tax Personal Property tax online using this service.

Property Tax payments may be sent via the US Postal Service to the Treasurers Office. You can also pay online and. Your property serial number Look up Serial Number.

SALES USE TAXES. Payments must be postmarked by. 2001 S State Street Ste N1-200 PO Box 144575 Salt Lake City Utah 84114-4575.

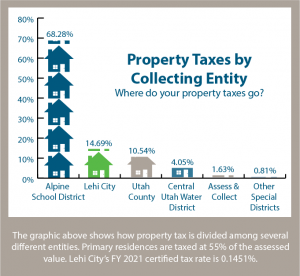

Do not mail cash with your return. This section discusses methods for filing and paying your taxes including how to file onlinethe fastest and safest way to file. Property taxes in Utah are managed through the collaborative effort of several elected county offices.

You can conveniently pay your real property taxes personal property taxes and mobile home taxes online. You will need your property serial number s. 0 Electronic check payment.

Cash or check payments. Monday - Friday 800 AM - 500 PM Pay in Person. If you are mailing a check or money order please write in your account number and filing period or use a.

Write your daytime phone number and 2021 TC-40 on your check.

Welcome To Davis County Utah Website For Real Estate Taxes

Property Valuation Notice Utah County Clerk Auditor

Pay Property Tax Summit County Ut Official Website

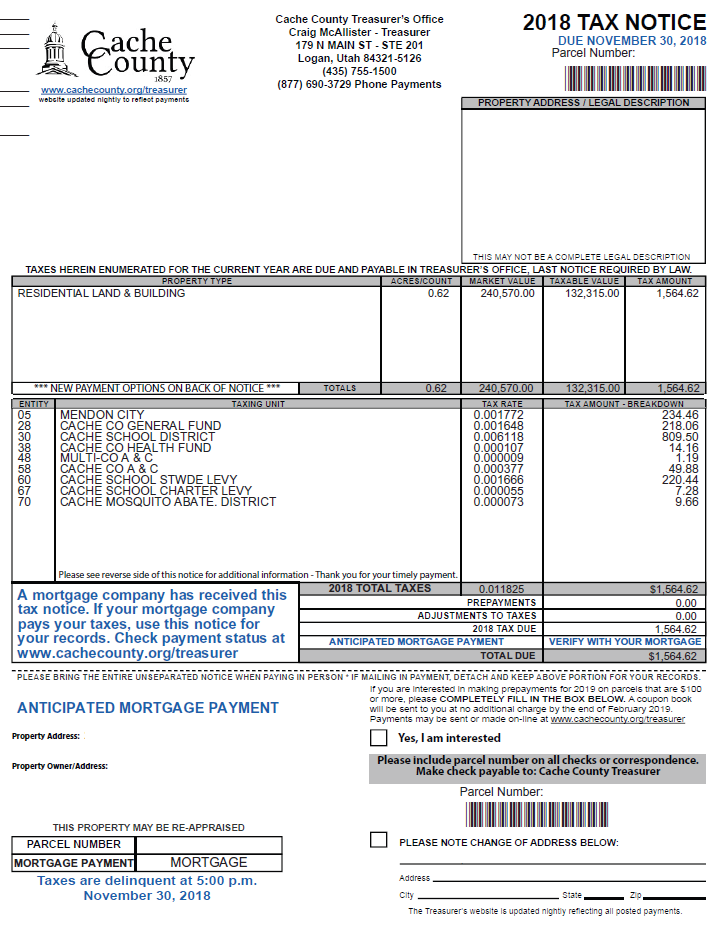

Official Site Of Cache County Utah Paying Property Taxes

Tax Bill Information Geary County Ks

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Property Taxes When To Consider An Appeal Choose Park City Luxury Real Estate Agents

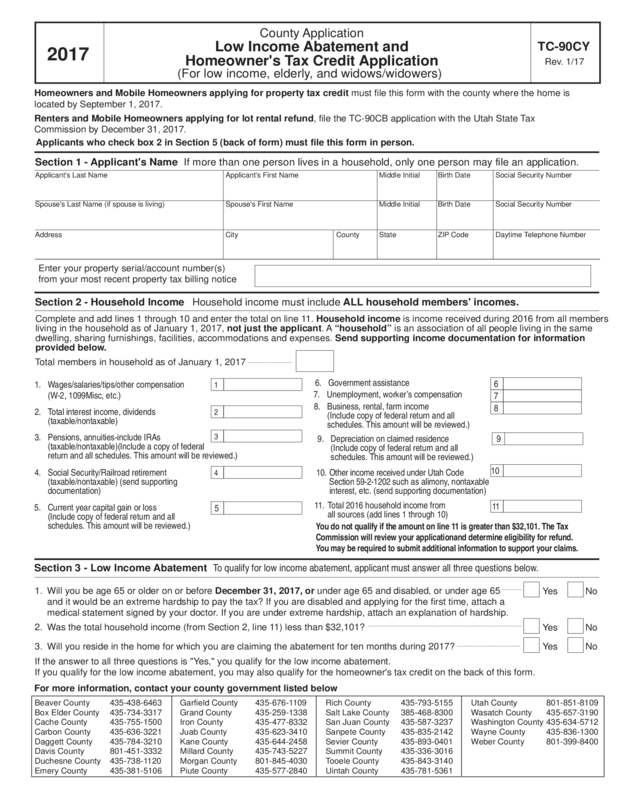

Tc 90cy Utah State Tax Commission Edit Fill Sign Online Handypdf

Make A Payment To Uintah County

General Sales Taxes And Gross Receipts Taxes Urban Institute

Working At Utah State Tax Commission Glassdoor